| Versione Italiana | |

| Articolo originale |

The aim of this paper is to better understand the role of public policy in facing obesity epidemic. Externalities imposed by unhealthy eating warn that health care system will be overwhelmed unless present trends are reversed. The role of public policy is a focus of attention in those areas where markets fail to operate perfectly.

Explanation for poor diets, market and behavioural failure

The utility-maximizing model of behaviour is the basis of the conventional wisdom across economists. The primary cause of increased obesity are technological changes which brought down the price of food (especially of processed-foods) and price of meals eaten away from home. Rising incomes have enabled people to purchase more food and have induced them to eat more often in restaurants or fast-foods. The increase of female labour force plays also an important role because has reduced household time dedicated to meal preparation. Finally, thanks to developments in medical technology, deaths from obesity-related diseases have fallen so sharply that obesity has become less dangerous, and so normal rational people can be less concerned about unhealthy implications. According to the rational choice paradigm obesity inducing lifestyles are an adaptation to external factors, preserving the overall goal of maximizing utility. To decrease obesity rates, it would be coherent – but unrealistic – modifying the external factors mentioned above.

Several are the limits to perfect rationality in behaviour. Imperfect and asymmetric information are standard examples of market failure. Nutritional labeling is the obvious policy response, even if requires a high level nutrition education and a willingness to devote time when shopping to read and react to label information. One possible solution to the shortage of time, is using traffic-lights symbols on packaged food. In addition, policymakers could use heuristics – experience-based techniques that help in problem solving – to take advantage of so-called bounded rationality (Simon, 1982). Public authorities, for example, could study effective communication strategies based on immediately effective messages, as the one that healthy eating coincides with the consumption of more fruits and vegetables.

The temptation afforded by cheap and unhealthy food leads some people to make choices they will later regret, and to postpone adopting a healthy eating and exercise regime (hyperbolic discounting behaviour). If this is the case, policy makers might consider using food stamps recipients to allow people to make food orders in advance and thus to prevent them from unhealthy choices.

As a relative new science behavioural economics remain controversy, especially in relation to its policy implications. Nevertheless has contributed, together with some psychological evidences, to reflect on key concepts as self-control, cognitive load, cognitive dissonance and framing (how information is presented rather than its content alone).

Finally, the supply side is also relevant in influencing obesity rates. Several studies demonstrated that people eat what is made available to them rather than that the producers make available what people want to eat. A direct consequence of it, is that people eat, for example, more fast foods in areas with a higher density of fast-food restaurants.

Evidence base to support policy making

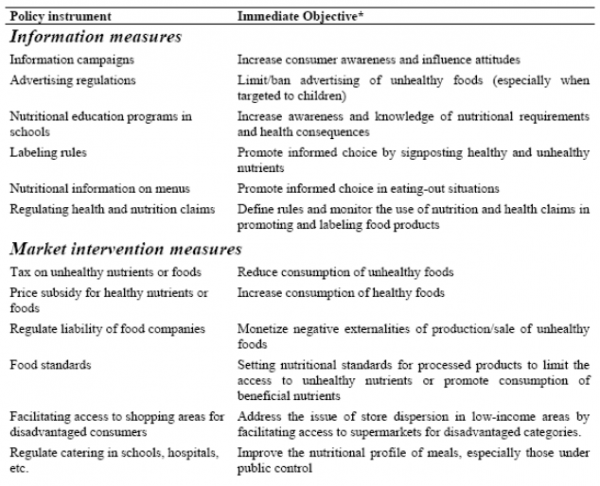

At macro-level, policy making in relation to diet and health is relatively new, so the evidence base for what is effected is still limited. Evaluation is complicated not only by the paucity of policies but also by the difficulty in obtaining relevant data. Regarding obesity, the situation is even more complicated because results, if any, will be visible only after years. One useful point of departure is to classify public policies aimed at reducing obesity, and divide them into market and information measures (Mazzocchi, Traill and Shorgen, 2009).

Table 1 - List of nutrition policy instrument classified by type of intervention

* Final objective of all interventions is to improve diets and/or reduce obesity to improve public health

Source: Mazzocchi, Traill & Shogren (2009)

Evidence suggests that information is essential for informed choice but may not promote healthier eating. There are several reasons for the failure – or limited – success of most information policy. Firstly people who already know poor diets have harmful long term health consequences, so they do not respond to confirmation of that knowledge. Second, healthy food may be viewed as less tasty, and consequently a low fat, low sugar or low salt label can lead to higher consumption of the “genuine” full flavor version. Third social marketing has to be well targeted to be effective, as it needs to provide the appropriate message to those specifically at risk. Anyway, even if poor diets can’t be changed by information policy alone, is interesting to consider some of its implications.

As regard the relationship between information, education and diet, for example, if uninformed or uneducated people overestimate the risks of unhealthy diets, they may respond by eating less healthy once informed or educated. Information measures are also intended to enable people to make private and individual decisions that maximizing their personal welfare. Policymakers should take into account that most people don’t consider medical and productivity costs imposed by obesity when making private decisions. Furthermore, it is desirable to examine policy effectiveness by population quantiles rather than estimate mean response. For example, it would be reasonable to expect that information on the health risk of obesity affects those most at risk, even if this assumption requires evidence. Finally, when evaluating information interventions, is important to consider the role of market forces. If supply is inelastic, higher demand leads to higher prices rather than higher consumption, which might worsen health inequalities.

There is growing interest in the use of fiscal measures to improve diets and make the prices people pay for food reflect their true social cost. The direct economic effect of a tax is that consumers lose welfare because they pay higher prices and consume less of the taxed goods than they would at market price. These losses are balanced by a gain in tax revenue and a gain in public health. For subsidies the situation is reversed: consumers, producers and public health all gain, but taxpayer loses because the subsidy must be paid.

Low-incomes consumers are most responsive to fiscal incentives and they would adjust their consumption more than the rich, thus gaining most in terms of reduced health risks.

Even if several studies have shown positive effects on consumers’ choice in using tax and subsidies, there are still many doubts about “fat tax” concept. It has been often dismissed as relatively ineffective because wealth consumers are not very responsive to food prices, as regressive because poor consumers spend the largest share of their incomes on food, and as unfair because the tax falls on those who are not obese as well as on those who are. A response to the first point is that previous studies have investigated only low-level taxes, usually at VAT rates. But it is generally accepted that cigarette taxis, for example, have been effective and they are applied at much higher level, as are taxes on alcohol. The evidence –base suggests that people respond to large incentives. Furthermore, if the financial burden is chosen judiciously, it won’t fall on poor in a disproportionate way.

Conclusions

In determining whether the obesity epidemic and poor diets merit a government response, two aspects have to be carefully considered. Firstly it has to be determined if poor diets are a result of market or behaviour failure, or if is the result of rational choice by informed people. Secondly, it has to be understood if it is possible to say that individual decision impose costs on the rest of the society. In both cases, cost-benefit analysis is needed to ensure intervention is justified. According to the author, we need to further develop the list of evidence-based policy effects.

There is also a growing body of research which suggests judicious selection of the targets of taxes, and subsidies can overcome criticisms of their being regressive and ineffective. Great hope is expected for a new EU funded project (EATWELL) whose goals include reanalyzing food consumption data to assess the effectiveness of past interventions wherever feasible.

Bibliography

- Cash, S.B., D.L. Sunding, and D. Zilberman (2005). Fat Taxes and Thin Subsidies: Prices, Diet, and Health Outcomes. Food Economics - Acta Agriculturae Scandinavica, Section C, 2(3-4): 167-174.

- Cutler, D.M., E.L. Glaeser, and J.M. Shapiro (2003). Why have Americans become more obese? Journal of Economic Perspectives, 17(3), 93-118.

- Mazzocchi M, Traill WB and Shogren J (2009). Fat economics: nutrition, health and economic policy, Oxford University Press, Oxford, 181pp.

- Mytton, O., A. Gray, M. Rayner, and H. Rutter (2007). Could targeted food taxes improve health? Journal of Epidemiology and Community Health, 61(8): 689-694.