| Versione Italiana | |

| Articolo originale in pdf |

Obesity is a big business. The prevalence of overweight and obesity has increased rapidly in the United States and the related health concerns are priority issues for the U.S. government and the medical community. The prevalence of overweight and obesity is particularly high in the United States but is growing rapidly throughout much of the world. Obese and overweight Americans generate large additional direct and indirect health care expenses.

The U.S. government has a stated objective of reducing obesity but the appropriate policy is not clear. Some options are to implement ever-more-vigorous public education programs, to revise the food and nutrition programs administered by the USDA to encourage healthier diets of participants, regulatory or fiscal instruments that attempt to discourage less-healthy and encourage more-healthy consumption choices (e.g. banning certain types of advertising, taxing foods with high fat or high sugar content, or subsidizing healthier foods such as fresh fruit and vegetables). To make a socially beneficial choice among these instruments requires understanding the likely effects of each instrument on food consumption (and other) choices by different types of consumers, the implications of those choices for patterns of obesity, and the consequences for social and private costs. In every instance it is difficult to make clear inferences because the empirical relationships are complicated and hard to quantify with confidence based on available information. Even so, some commentators have been able to take strong positions on the issue.

One popular idea is that American farm subsidies contribute significantly to obesity and that reducing these subsidies will go a long way towards solving the problem (Pollan, 2003). Pollan and others making such claims generally treat the issue as essentially self-evident, and do not present details on the mechanism by which farm subsidies are supposed to affect obesity, nor evidence about the size of the impact.

We examine the links between farm programs and farm commodity prices in the United States, and the implications of farm policy-induced commodity-price changes for food prices, food consumption, and obesity, drawing on both U.S. data and some international comparisons of farm supports, food prices, and obesity rates. We conclude that U.S. farm programs have had negligible effects on the prices paid by consumers for food and thus negligible influence on dietary patterns and obesity, consistent with some previous work by economists on the issue (e.g., Alston et al., 2006; Miller and Coble, 2007), but contradicting the mainstream view presented in the media.

Farm subsidies, farm commodity prices, food prices, consumption, and obesity

It is conceptually possible that farm subsidy policies contribute to lower relative prices and increased consumption of fattening foods by making certain farm commodities more abundant and therefore cheaper. However, each of several component elements must be true for the effects on obesity to be significant. First, farm subsidies must have made farm commodities that are important ingredients of relatively fattening foods significantly more abundant and cheaper. Second, the lower commodity prices caused by farm subsidies must have resulted in significantly lower costs to the food industry, cost savings that were passed on to consumers in the form of lower prices of relatively fattening food. Third, food consumption must have changed significantly in response to these policy-induced changes in the relative prices of more- versus less fattening foods.

In what follows we examine each link in this chain, and we find that the magnitude of the impact in each case is zero or small.

1) Farm subsidies have had very modest (and mixed) effects on the total availability and prices of farm commodities that are the most important ingredients in more-fattening foods. U.S. farm subsidy policies include hundreds of specific provisions for particular commodities including both farm bill programs and trade barriers that raise U.S. farm prices and incomes for favored commodities. These programs support farm incomes either through transfers from taxpayers, or at the expense of consumers, or both. In reality, then, farm commodity programs might make agricultural commodities cheaper or more expensive and might therefore increase or reduce the cost of certain types of food.

A simplistic model of farm subsidies and obesity, which is implicit in some writings on the subject, presumes a text-book subsidy policy that results in an increase in both production and consumption of the subsidized good by increasing the net return to producers (the market price plus the subsidy) and lowering the market price paid by consumers.

Farm subsidies have resulted in lower U.S. prices of some commodities, such as food grains or feed grains, and consequently lower costs of producing breakfast cereal, bread, or livestock products. But in these cases, the price depressing (and consumption enhancing) effect of subsidies has been contained (or even reversed) by the imposition of additional policies (such as acreage set-asides) that restricted acreage or production. In addition, for the past decade, about half of the total subsidy payments have provided limited incentives to increase production because the amounts paid to producers were based on past acreage and yields rather than current production. Finally, for some commodities (notably sugar, dairy products, and orange juice), the U.S. policy increases U.S. farm prices by restricting imports, with the effect of increasing consumer price and decrease domestic consumption.

2) Such small commodity price impacts would imply very small effects on costs of food at retail, which, even if fully passed on to consumers would mean very small changes in prices faced by consumers.

The cost of farm commodities as ingredients represents only a small share of the cost of retail food products, on average about 20%, and much less for products such as soda and for meals away from home, which are often implicated in the rise in obesity. Hence, a very large percentage change in commodity prices would be required to have an appreciable percentage effect on food prices. However the effects of U.S. subsidies on farm prices of food commodities have been generally quite small.

3) Given that food consumption is relatively unresponsive to changes in market prices, the very small food price changes induced by farm subsidies could not have had large effects on food consumption patterns.

A useful perspective on this issue is provided by Miller and Coble (2007) who graphed total expenditure by the U.S. government on direct payments (a type of subsidy expenditure) on the same scale as consumer expenditure on food for the years 1960 through 2003. Over the period, this measure of subsidy expenditure averaged only 1.1% of consumer expenditure on food.

Evidence from international comparisons

Limited use to date has been made of international cross-sectional data, which is probably the most likely context to yield meaningful direct evidence on the links between policy and rates of obesity.

A measure of support for agriculture is the Producer Support Estimate (PSE) computed by the OECD. This measure includes all transfers to producers whether through government expenditure or other means, some of which are at the expense of consumers rather than taxpayers. The counterpart Consumer Support Estimate (CSE) effectively measures the net effect of agricultural policies on consumers from taxpayer expenditures, which benefit them by reducing prices, and other policies such as import tariffs, which raise consumer prices.

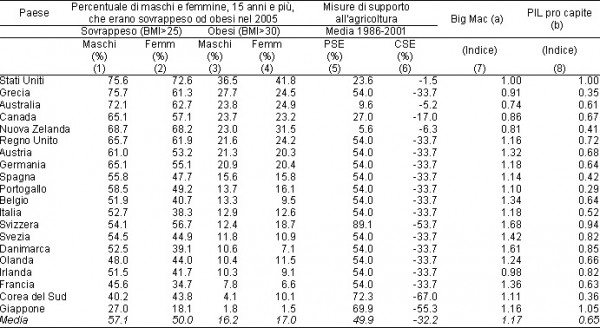

Table 1 compares rates of obesity in 2005 with rates of overall farm support (measured using PSEs over the period 1986–2001) for a selection of OECD countries. It can be seen that obesity rates are much lower in Japan, South Korea, and France (countries that provide relatively large subsidies to farmers) than in the United States and Canada (countries that provide substantial but smaller subsidies). Obesity rates in Australia and New Zealand, which do not subsidize their farmers much at all, are higher than in France and Japan but still lower than in the United States. This table shows that there is no clear connection between support for farmers in a country and obesity in that country. For instance, the countries of the European Union all have the same farm support policies, under the Common Agricultural Policy, and thus the same PSEs, but their obesity rates range from close to the highest in the table (Greece) to close to the lowest (France).

The more appropriate comparison is between obesity rates and the measure of farm subsidy effects on incentives for consumers, measured using CSEs. From inspection of the numbers in Table 1, we cannot rule out a positive correlation between the CSE and the rate of obesity. Importantly, and as discussed above, the overall average CSE for the United States was negative—indicating that farm subsidies entailed a net tax on consumers—but close to zero such that the magnitude of the effect, if any, must have been very small.

More direct, and perhaps corroborating, evidence may be gleaned by considering the consumer prices of food among countries. The Big Mac index from The Economist—the annual country-specific price of a McDonald’s Big Mac hamburger—is useful for this purpose since it holds the characteristics of the food product (representing a bundle of food commodities and other inputs) fairly constant across countries and over time. Reading down Table 1, like the CSE in column (6), the value of the Big Mac index in column (7) generally increases in size, while the corresponding rate of male obesity in column (3) increases. Thus there is some correlation between the effects of policy on consumer costs of food commodities (as measured by the CSE) and both the consumer costs of food (as measured by the Big Mac) and the prevalence of obesity. These correlations are illustrated in Figures 1–3.

Table 1

Source: Alston et al. (2008)

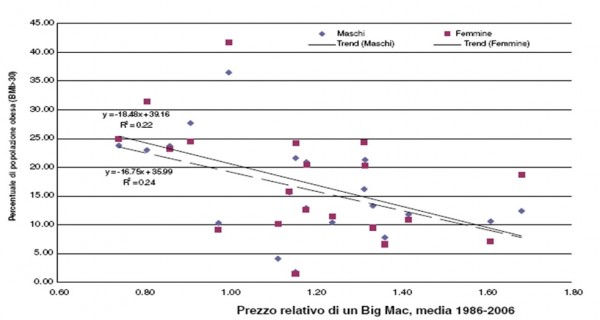

Figure 1

Source: Alston et al. (2008)

Figure 1 plots the country-specific percentages of men and women who were obese in 2005 against the average value over 1986–2007 of the relative price of the Big Mac (the ratio of the country-specific price in U.S. dollars to the U.S. price). These graphs show that for these relatively rich countries, obesity is negatively correlated with the price of food, as represented by the Big Mac, although there is a great deal of variation around the downward-sloping simple trend line, with the United States (at the top) and Japan (at the bottom) a long way from the line.

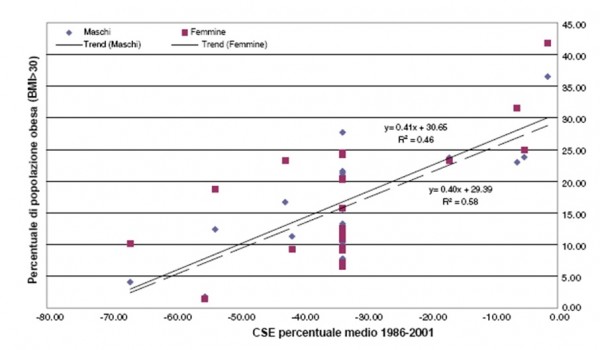

Figure 2

Source: Alston et al. (2008)

Figure 2 plots the country-specific percentages of men and women who were obese in 2005 against the average value over 1986–2001 of the total CSE for food commodities. For all countries, the CSE was negative indicating that agricultural policies transferred income to producers at least partly at the expense of consumers, by raising the buyer price above the world price. Higher rates of consumer taxation (larger negative CSEs) tend to be associated with lower rates of obesity, but again there is a great deal of variation around the trend.

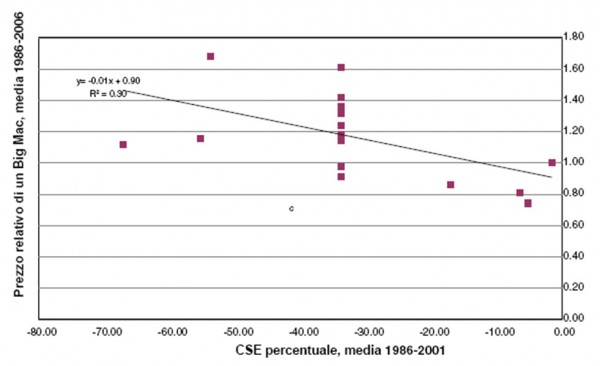

Figure 3

Source: Alston et al. (2008)

Figure 3 plots the country-specific average value of the Big Mac index over 1986–2007 against the corresponding country-specific average value of the CSE over 1986–2001. The Figure indicates a generally positive relationship between a higher cost of food commodities in a country (as indicated by a larger negative value of the CSE) and the Big Mac price, supporting a conjecture that those countries that had lower obesity rates associated with higher consumer prices of food may have done so in part because they had policies that raised the buyer cost of food commodities.

This informal analysis of correlations among obesity, food prices, food commodity prices, supports a view that policies that reduce (or raise) the domestic price of food commodities can influence food prices, food consumption, and obesity. Thus, even though U.S. farm subsidies in the past have not had significant effects on U.S. rates of obesity, and eliminating them would not contribute significantly to reducing obesity rates, other policies that have (or have had) more significant effects on food commodity prices may well have (or have had) more important effects on obesity (chief among these is public support for agricultural R&D).

References

- Alston, J.M., Sumner, D.A., Vosti, S.A. (2008). Farm subsidies and obesity in the United States: National evidence and international comparisons. Food Policy, 33: 470-79.

- Alston, J.M., Sumner, D.A., Vosti, S.A. (2006). Are agricultural policies making us fat? Likely links between agricultural policies and human nutrition and obesity, and their policy implications. Review of Agricultural Economics, 28 (3): 313–322.

- Miller, J.C., Coble, K.H. (2007). Cheap food policy: Fact or rhetoric? Food Policy, 32: 98–111.

- Pollan, M. (2003). The (agri)cultural contradictions of obesity. New York Times, October 12.