| Versione Italiana |

Abstract

In the case of agricultural commodities, price rarely equates long run marginal cost, a circumstance which ruins market optimality. Thus, agricultural policy should be focused on market failures, as was the case with the 1960 CAP. But a permanent price guaranty for unlimited quantities, another feature of the latter, is infeasible as well, automatically leading to over production. An active agricultural supply management system is therefore necessary. In addition, externalities and commodities are joint products, which cannot be managed independently, thus creating inconsistencies in the present schizophrenia between modern CAP pillar 1 and 2. Under certain conditions, a generalized “quota” system would provide safer instruments for environmental policy.

Keywords : Common Agricultural policy; Price volatility; State intervention; market failure; supply management.

A major break in the European Union Common Agricultural Policy (CAP) occurred in 1992. Before that date, all efforts tended to isolate the European agriculture from market, at least for the main commodities. After, everything is done to let markets decide what to produce and where. The so-called “pillar 1” of the CAP is shrinking every year.

This does not mean a complete withdrawal of the State from the management of agriculture. Under the cover of “pillar 2”, an increasing share of the agricultural budget is spent as “decoupled” payments, that is, subsidies which should not modify the marginal cost of production, and, therefore, should not interfere with markets, while allowing to manage “externalities”. Indeed, if partially justified by vested interests, because farmers, through price support, got large incomes which could not be removed at once, these subsidies are essentially linked with the fact that there are no prices for landscape or other agricultural amenities, no more than penalties inflicted by markets for pollution from fertilizer or pesticides. Since there exist reasons to create amenities or avoid pollution, the State may create some sort of artificial markets for these goods, generating incentives for “good practices”. Thus, farmers are granted large subsidies subject to “eco-conditionality” restrictions.

The shift from “pillar 1” (market related) and “pillar 2” (rural development) expenses reflects this change in philosophy. Yet, the main idea developed here is that pillar 1 is still the most important and reasonable aspect of the CAP. First the theoretical reasons which induce this thinking will be examined. Then, a few political sciences considerations will be developed.

Why is it necessary for political authorities to care for agricultural markets?

The key consideration here is that agricultural markets are not working properly. This is the only and sufficient reason for State intervention in production decisions.

The most obvious market failure is precisely what Pillar 2 is supposed to bring correction to. As we have seen, is has been originally designed for, as far as possible, recreating markets where they are missing. In that way, everything would be market oriented, even the non marketable.

Two observations must be made at this stage : First, these “externality markets” are only token ones: for the key problem here is not to allocate pollution rights or amenity production quotas between producers, but to decide which pollution level is admissible, or which amenity is demanded in which quantity. For this, no market indications are available.

Second, it is completely impossible to do that completely independently of pillar 1 considerations: for pollutions, amenities and commodities are obviously joint agricultural products, and jointness is notoriously a difficulty in production economics.

Further researches should (and are) undertaken in order to grasp all the aspects of the problem. Yet we shall not pursue this discussion here, and just concentrate our attention on the pillar 1 issues – the commodity market failures.

Idly functioning markets : testimonials

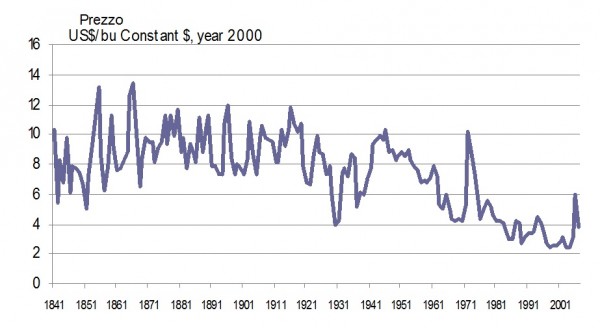

Indeed, if markets were working as they do in first grade economic courses (that is, marginal cost equating price, thus maximizing the joint consumer and producer surpluses), no pillar 1 type agricultural policy would have ever been necessary. If such policies were progressively set up during the course of history, it is because such situation only rarely occurs. Indeed, most of the time, on actual agricultural markets, prices do not equate marginal costs, as illustrated on Figure 1 : Nobody can seriously imagine the marginal cost of corn being 513 in 1910, reaching 764 in 1911, and coming back to 508 in 1912… This is but an example: similar jumps can be observed with almost any available agricultural commodity free market price in the world.

In the absence of relation between costs and price, markets lack all pretence to optimality. On the contrary, market interventions might very well lead to second best optimality, with price closer to “true” long run marginal costs, where the joint sum of producer and consumer surpluses is maximized. The advanced economic theory, incorporating risk aversion considerations, reinforces the argument. (1)

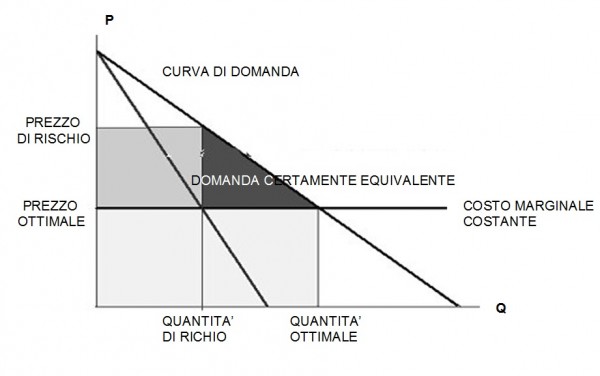

In effect, most of the time, farmers are risk averse (2). A risk averse producer does not equate marginal cost with the mean, but with the “certainty equivalent” price. The certainty equivalent is normally far below the mean price, the more as price volatility is larger and the farmer poorer (Figure 2) . This means that with volatile prices, production is constantly below the Pareto optimum level.

Figure 1 : US corn price 1860 - 1998

Figure 2: Non optimal equilibrium with risk

Thus, both observation and theory suggest that price stability could lead to a more efficient agricultural system. That was the key motivation for the 1960 CAP setting, following earlier similar policies (especially, US) established in the late 30’s. Now, in the late 80’s, these policies (both US 1935 AAA policies and the CAP) has been deemed failures– the 1992 CAP reform being a mere consequence of this analysis. Where was the problem ?

What was wrong with the 1960 CAP ?

Insurance is a natural idea for dealing with (apparently) random events such as agricultural price fluctuations. But it is difficult to insure prices, because prices are high or low for everybody at the same time. Therefore, even assuming random “iid”(3) prices, risk sharing must be done throughout time, “bad” years being compensated by “good” ones. This raises enormous financial problems which can hardly be left to private insurance firms, so affluent they might be. But governments can (and should) do it (Arrow and Lin, 1970). Here was the rationale behind the 1960 PAC. Assuming guaranteed price set at the long run equilibrium level and linked with a system of variable levies and subsidies at the border, the mean cost should have been nil, because the cost of exports during “good years” (production exceeding domestic consumption) would have been compensated by import duties receipts during bad years (when short domestic supply must be compensated by import). The production and consumption system should have behaved exactly as with a smooth and efficient free market. Indeed, government fixed price stands as the perfect price insurance system. Yet, there was a flaw in the reasoning. In the case of agriculture, supply in the long run is fairly elastic, because the production function is homogenous of degree one: if a technique is profitable over one hectare, it can be reproduced over millions of hectares. Elementary economic theory shows that, in this case, the marginal cost is constant and the supply curve is flat, parallel to the x axis. Of course, this is not completely true, because fixed factors, such as land, cannot be expanded without limits. But the share of land in agricultural production cost is too small for the slope of the supply curve to be large, so that, in practice, everything goes as if the supply curve was nearly flat. Now, with a fixed price, the demand curve too is flat, parallel to the x axis… and two parallel lines cross over at infinity. Here is the explanation for the failure of the 1960 CAP (and all similar policies in the world). With fixed price for unlimited quantities, production always tends to supersede demand. And, of course, in such a setting, the policy cost becomes quickly insuperable (4).

What could have been done ?

In this context, authorities, to get rid of surpluses, are considering coming back to free market. This is clearly absurd, since coming back to free market will just lead to the same difficulties which were at the very origin of its abandonment.

Yet, a very natural idea to overcome the difficulty of overproduction is to put a bound on the government price guaranty: a relatively high price would be granted up to a certain quantity, while any quantity produced in excess of this “quota” could be sold at market price. Such a solution, supported by serious economists (such as Hazell and Scandizzo, 1977) can be interpreted as a kind of future market, with the government playing (at virtually no cost) the role of a risk buyer speculator. It is not distorting: provided the sum of allocated quotas be less than domestic consumption, the quantities sold on the international market would be produced at marginal cost. That such simple an idea has always been considered with reluctance by politicians and economists is indeed very strange.

Political economy considerations

Why are policy makers so reluctant in face of market regulation?

Several reasons can explain the reluctance for supply management.

- The bad repute of the rents associated with “quotas”: since, in order for the production under quota to be secured, the “under quota” price must be fairly greater than cost (otherwise, the quantity under quota would not be certain to be produced), farmers get a profit from holding quotas. Most neoclassical economists are rightly severe against rents.

Now, it remains to be ascertained if rents should be necessarily avoided every time everywhere. They are recommended in certain cases: for instance, nobody, apparently, complains about rents derived from patents. This is because, (rightly or wrongly) the benefit of such patent rent are deemed necessary to encourage research and innovation, which, otherwise, would be deprived of any market.

In the specific case of the rent associated with production quotas in agriculture, it could be justified by a similar argument: the difference between price and average cost, in this case, is indeed a price paid by consumer for food security and technical progress, since, in the absence of such a device, farmers would be reluctant to invest and innovate. Then, why complain about quota rents (5)? Moreover, the “quota rent” can very well reduced to a small value if the authorities are wise (and powerful) enough to revise quota price at regular intervals, tacking account of technical progress and changes in production costs. - Most politicians are persuaded that the reason for setting an agricultural policy is to guarantee a minimum income to farmers. This is the rational for limiting the decoupled payments beyond a certain limit: “big” farmers need not income supports.

But mixing equity and efficiency considerations is awkward. Decoupled payments are made to compensate farmers for the costs they incur as a consequence of the lack of markets for some of their productions. Unless these costs are smaller for large than for small farmers, (which remains to be demonstrated), one does not see the reason for depriving large farmers from compensation. If more equity is required in the distribution of wealth, other instruments exist to bring it in, such as income tax. - The very source of price fluctuations (and therefore, the strategies for bringing remedies) are not understood. Of course, everybody agrees that large agricultural price fluctuations are caused by small changes in supply which are magnified by the low demand elasticity for food. But few analysts recognize market failures behind supply changes. It is generally admitted that such changes are of “exogenous” origin. They would be engendered by climate or pests, all causes out of any human control. Yet, if climatic or other circumstances can very well jeopardize local harvests, the question is open of the consequences of this sort of events for global markets: can a drought occur simultaneously in Australia, North America and Europe? This is not very likely.

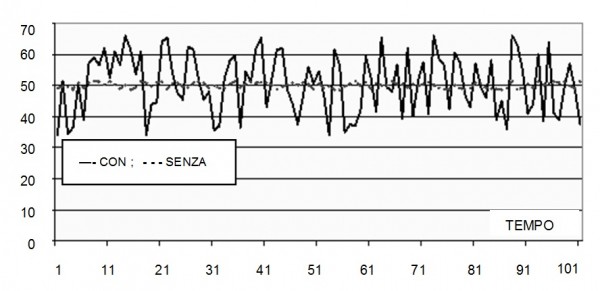

On the contrary, since Ezekiel (1938), the author of the “cobweb model”, the local instability and “repelling” properties of agricultural markets equilibrium points is notorious. With a repelling equilibrium point, the way is paved for chaotic (6) behaviours in the agricultural commodity supply and demand dynamics (Alligood et al., 1997). Now, the global properties of a chaotic system are completely different from those of an exogenously perturbed equilibrium. In particular, while all “liberal” recipes are stabilizing the latter, they are counterproductive with the former, and vice-versa (Boussard, 2005). Since most economists (and probably, all the most influential of them) are persuaded fluctuations come from exogenous sources while they are endogenous, it is not surprising that policies are misdirected. - Especially, it has been contended that national quota were unfair at international level, because they were destabilizing the world residual market. This would be true if the international markets fluctuations were of exogenous origin, as it can be seen on Figure 3:

Figure 3 Endogenous shocks : residual market price, with and without quotas (7)

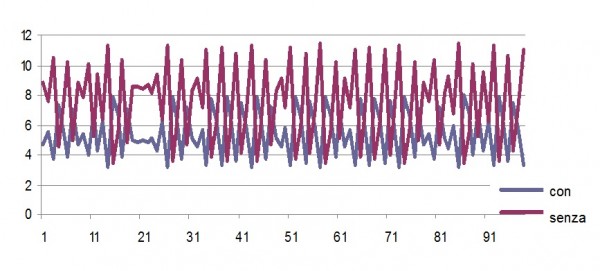

The results displayed in the case “with endogenous fluctuations” (Figure 4) are quite different. Here, although the supply and demand on the two markets are similar (the scale is different), the fluctuations are generated by a risk driven chaotic cobweb (Boussard, 1996). In this case, the series “without quota” fluctuates much more than the series “with quota”. In this context, the imposition of a quota, far from increasing price volatility, is stabilising, because it guarantees at least a minimal production, preventing low supply/high price situations (8).

Again, the above example is only illustrative. The source of agricultural price fluctuation is always both endogenous and exogenous, which does not simplify the stabilisation problem. Yet, the above discussion shows at least the importance of making a distinction between the two, and of designing policies in accordance.

Figure 4 (9) - Chaotic cobweb : residual market price, with and without quotas

Can pillar 1 be independent of pillar 2 ?

There exist also large contradictions between pillar 1 and pillar 2. For instance, the difficulty of producing milk in mountainous regions is well known. At the same time, tourists like watching cows in mountain. The two pillar logic would lead to leave the market free to determine where producing milk at least cost (which is surely in plains!) while paying farmers to nevertheless produce some in mountains. The same result was actually achieved by the milk quotas in France, because quotas were mobile (they can be transferred from one farmer to another) only within certain geographical zones, thus guarantying a certain amount of milk production in mountains, without having to compute the difference in cost between milk production in plain and in mountains.

Again, this is but an example. But similar reasoning could be made for many other situations. The core of the thing is that it is not theoretically possible to completely dissociate commodity and environmental decisions. Then, why not taking notice of it, and acting accordingly?

Concluding remarks

Thus, despite the efforts to bring the CAP – especially pillar 1 – meeting the standards of economic rationality, one has to be afraid that it is heading right down in the opposite direction. There is not the least rationality in decoupled payments. Abandoning all ideas of market management is both strange and dangerous while the malfunctioning of markets is precisely the reason for installing any agricultural policy.

The recent evolution of the world markets, with depleted security stocks and soaring agricultural prices could very well make this judgement obviously relevant. Contrary to a common creed, the shortage of grains in summer 2007 was not due to the drought in Australia, and probably not (or not yet!) to the bio-fuel production. It is the consequence of many market transmitted messages, which, for several years, have been indicating that agricultural production was too large. World farmers received these messages well, and acted accordingly by reducing supply, although probably too late, and too much…

Similarly, in 2008, the message according to which production is too low has been transmitted at once, resulting in large investments (there has been a fertilizer shortage in 2008!), over supply, depleted prices, farmers bankruptcy, and call for farm income support in 2009. In the meantime, a number of poor peoples in the third world died from hunger...

A possible way out of such absurdities is a careful management of agricultural (as well as bio-fuel) markets, through price and supply control on both sides. It could be future of the CAP pillar 1 if the EC wants to keep control of events. If not, especially if EC continue its ideological retreat far from reality, it is to be expected that other institutions – perhaps nations, perhaps international bodies – will seize the relay.

In particular, nowadays, contrary to the situation which prevailed before the Second World War, the rise in urbanisation makes direct contacts between farmers and final consumers very difficult. Food industry stands as a necessary intermediate body. Through vertical integration contracts, it could very well play the role of a market regulator, thus privately replacing all forms of State intervention. Of course, such a new institutional setting would only be workable if food industry firms benefit from large monopoly rents. But in the absence of government intervention, these rents are the more easily obtained and kept as, because they require transportation, the corresponding processes (at least potentially) stand as natural monopolies. It is not sure the consumer (or even the tax payer) would really benefit from such a situation.

Note

(1) A considerable body of literature was devoted to this topic during the 50’s and the 60’s. Perhaps because it is not easily found on Internet, it seems to have almost entirely forgotten recently. See Waught(1944), and many others.

(2)The fact has been challenged( Binswanger,1980). In practice, everything goes “as if” they were really risk averse.

(3) Independently identically distributed

(4)This outcome of the 1960 PAC had been predicted by Colin Clark (1962).

(5) Unfortunately, this caveat was not understood at the time. Indeed, assuming stabilisation could be achieved through futures markets, the risk premiums to be paid to speculators would largely exceed the rents paid to quota owners…

(6) Here, we refer to the mathematical theory of chaos – a special case of dynamic differential equations solutions, with no periodicity, and no ultimate fixed limit when time growth to infinity. (7) Here, a government imposes a production quota on a domestic market. Production price is guaranteed for the average domestic consumption level,Q*, corresponding with the supply and demand equilibrium quantity, thus planned each year. But the planned quantity is submitted to random shocks, so that actual production is uniformly distributed between Q*-10% and Q*+10%. Each year, the deficit or oversupply is bought or sold on a residual foreign market defined by its demand curve, and its autonomous supply uniformly distributed between q*-10% and q*+10%, where q* is the equilibrium quantity on the residual market, and Q*/q*= 100. The residual market price is highly volatile, as shown by the continuous line. If the quota is removed, and price determined by merging the supply and demand of the two markets the price is stabilized, as shown on the dotted line, illustrating the benefit of liberalization whence fluctuations are exogenous.

(8) as a consequence, insofar as the world sugar market is driven by such a kind of fluctuations, it will be even more volatile in the next few years, when the EC sugar quotas will have completely been removed.

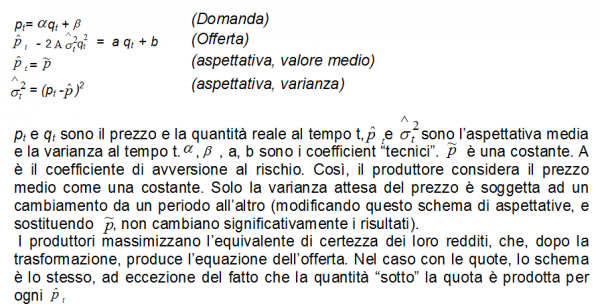

(9) Here, the series “without quota” is engendered by a set of four recursive equations :

Riferimenti bibliografici

- Alligood, K., T.D. Sauer, and J.A. Yorke (1997) Chaos : An introduction to dynamical systems. Springer, New York.

- Arrow, K.J. et R.C. Lin (1970) : “Uncertainty and the evaluation of public investment decision”. In Arrow, K.J. (editor) : Essays in the theory of risk bearing, North Holland, Amsterdam, 1971.

- Boussard J.M. (1996) “When risk generates chaos”, Journal of Economic Behavior and Organization, 29 (96/05), 433-446.

- Boussard, J.M. (2005) “Price risk management instruments in agricultural and other unstable markets” ICFAI journal of risk and insurance 3(2) : 6-19 Clark, C. (1962) “Agricultural Economics - The Further Horizon”, Journal of Agricultural Economics, December.

- Ezekiel, M. (1938) “The Cobweb Theorem”, Quarterly Journal of Economics 53 : 225-280.

- Hazell, P.R., and P. Scandizzo (1977) “ Farmers’ expectation, risk aversion and market equilibrium under risk”, American Journal of Agricultural Economics, 59 : 204-209.

- Waught F.V. (1944) : “Does the consumer benefits from price instability ?” Quaterly J. of economics 58 (3) : 602-614.